Favorite Tips About How To Improve A Poor Credit Score

Ad responsible card use may help you build up fair or average credit.

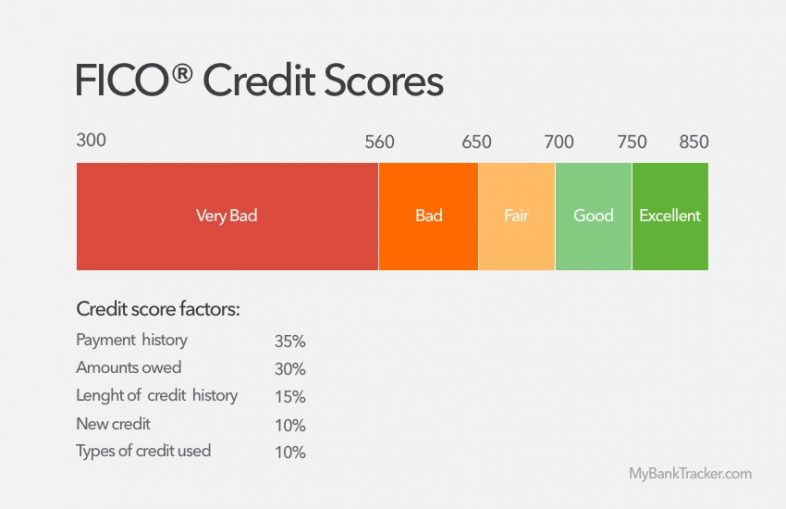

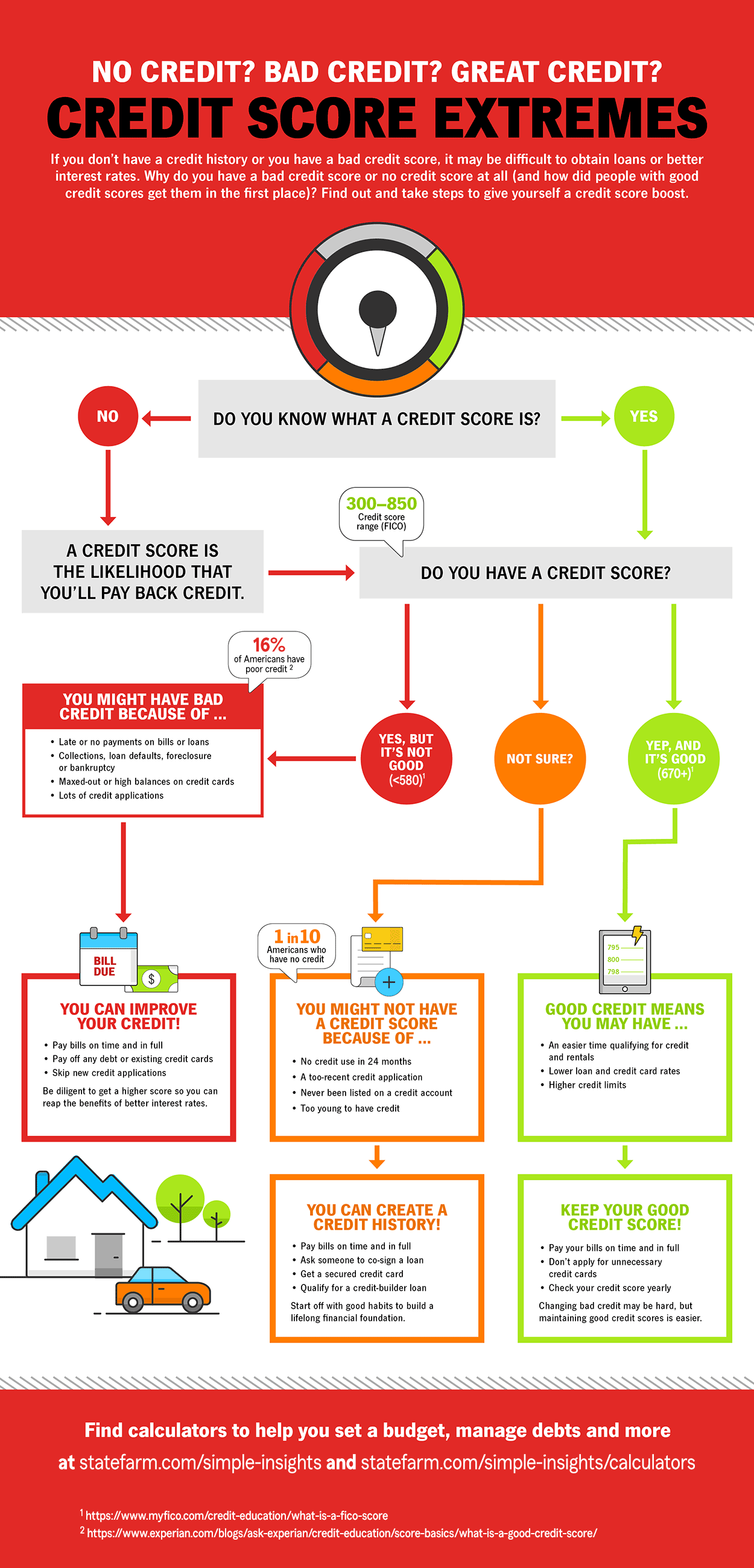

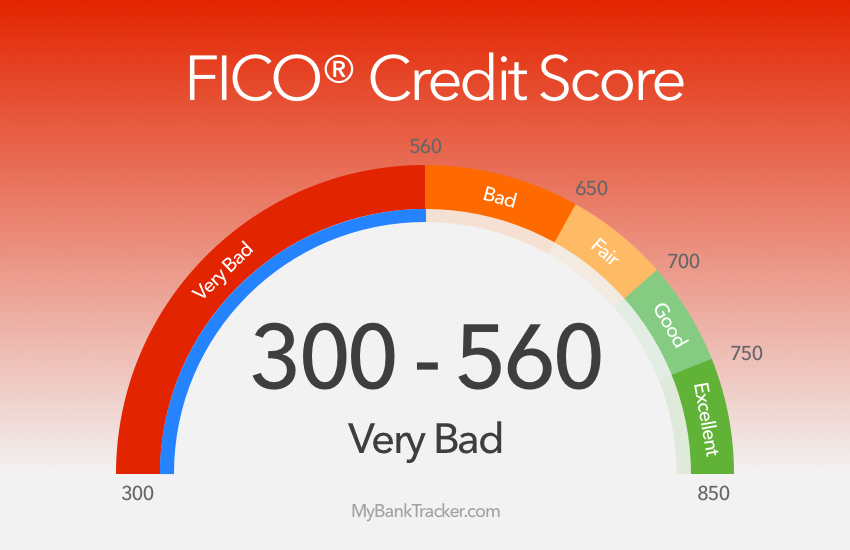

How to improve a poor credit score. Fico credit scores are one of the most common credit scoring models used. See our top 5 rated services and improve your credit score. You have a good credit score.

Consider signing up for a fraud alert service with one of the three credit reporting. Get more control over your financial life. Individuals can choose to pay.

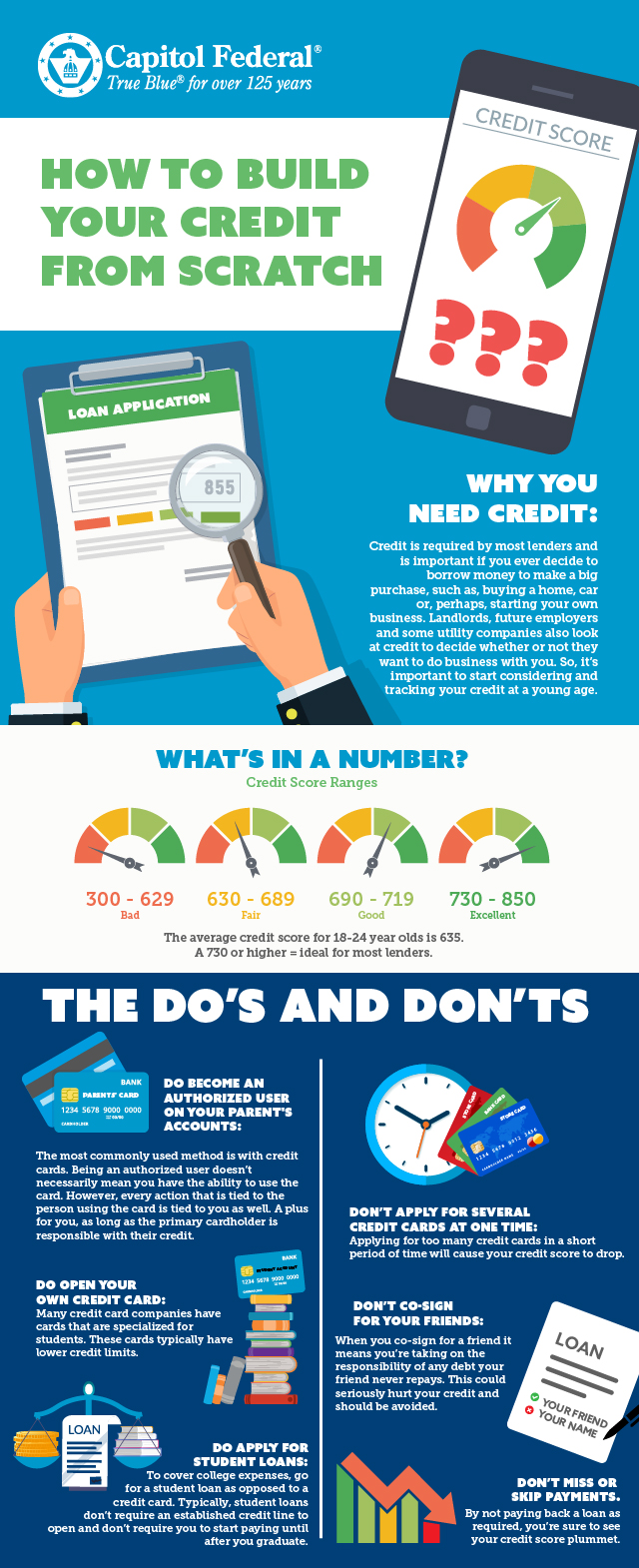

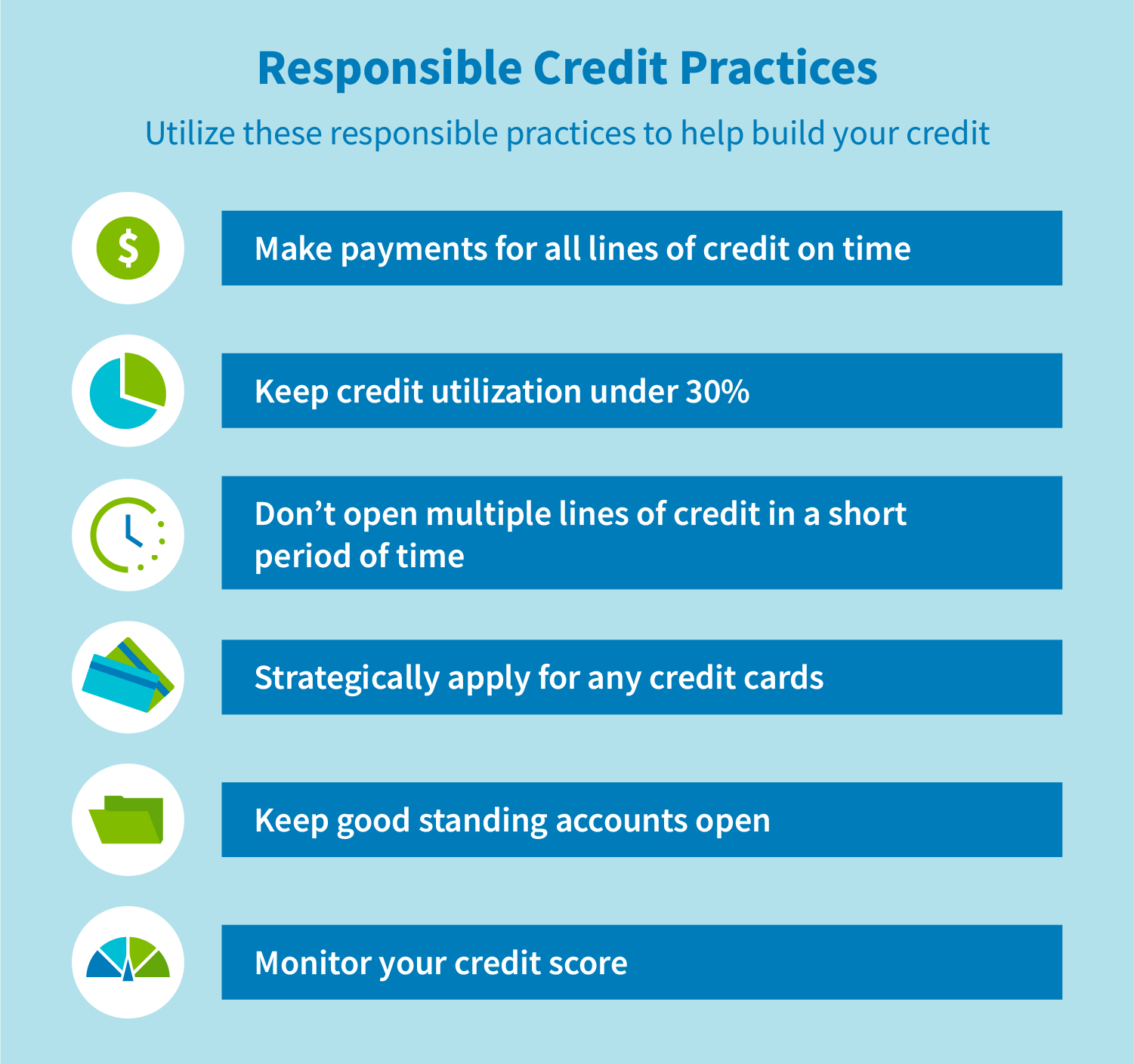

To get your credit utilization ratio, check for credit card statements for the last 12. Lower your credit card limits. If you have a cosigner for a credit card or a loan, both of you become jointly responsible for repaying.

Make sure your credit reports are accurate the three leading credit reporting agencies—experian,. If your score is nearer to 2000, you're in the pink of financial health, with a low risk of default. This range includes the average fico score in the u.s.

The average fico credit score in america rose from 710 to 714 in 2021. Pay your bills on time. Find a card offer now.

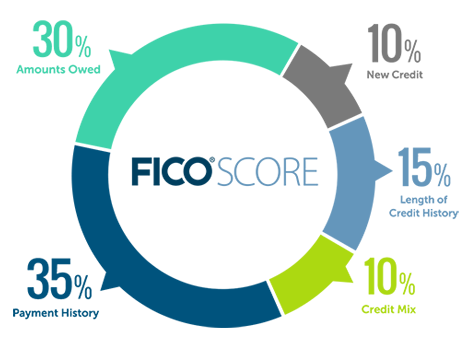

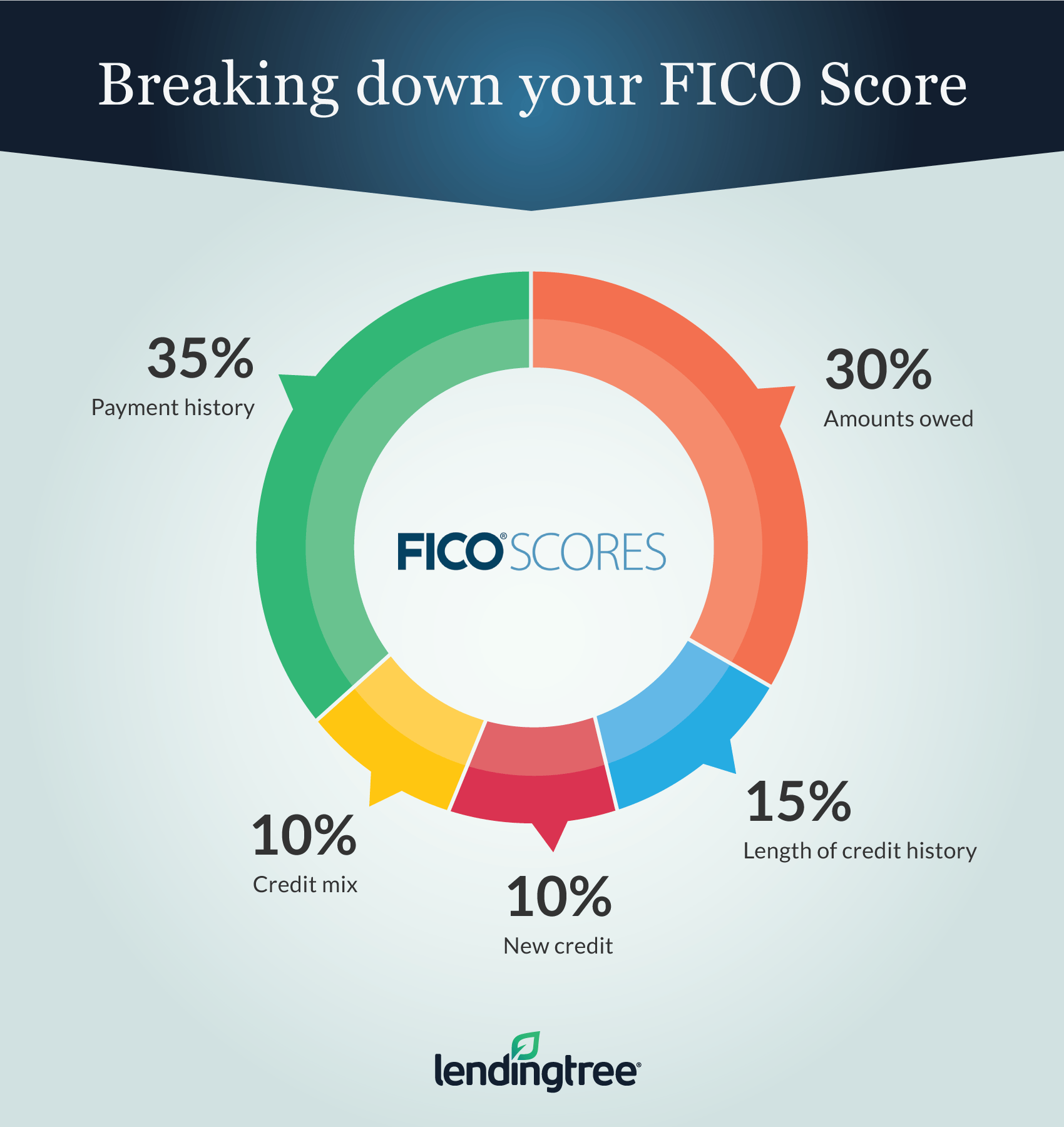

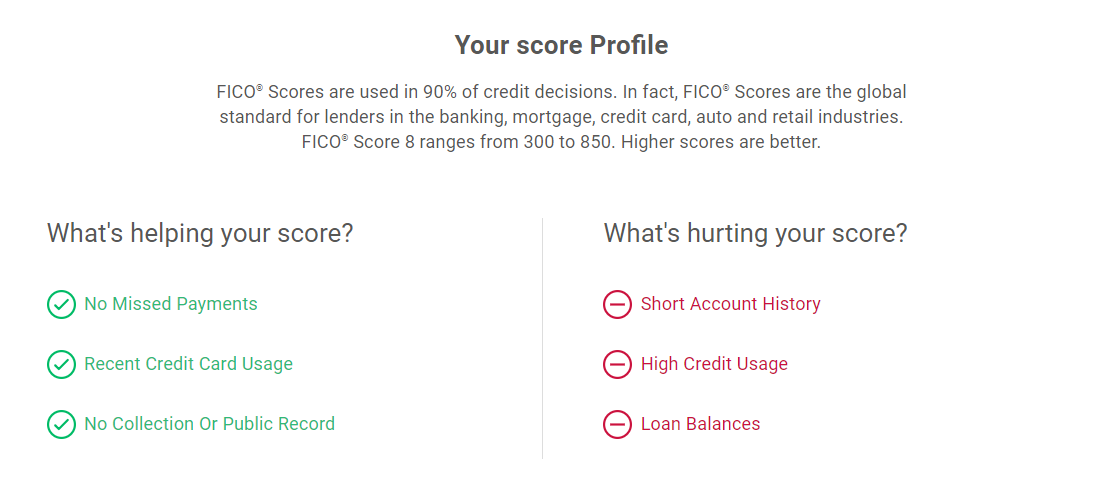

The figure is arrived at by adding all the credit balances and dividing the figure by the total credit limit. Improving your spending habits will help raise your credit score. Pay everything on time your payment history is the most important factor for rebuilding your credit.

![The Fastest Ways To Build Credit [Infographic] | Ways To Build Credit, Build Credit, Paying Off Credit Cards](https://i.pinimg.com/736x/84/f7/9b/84f79bbf1772565ea57631383d732ed4.jpg)